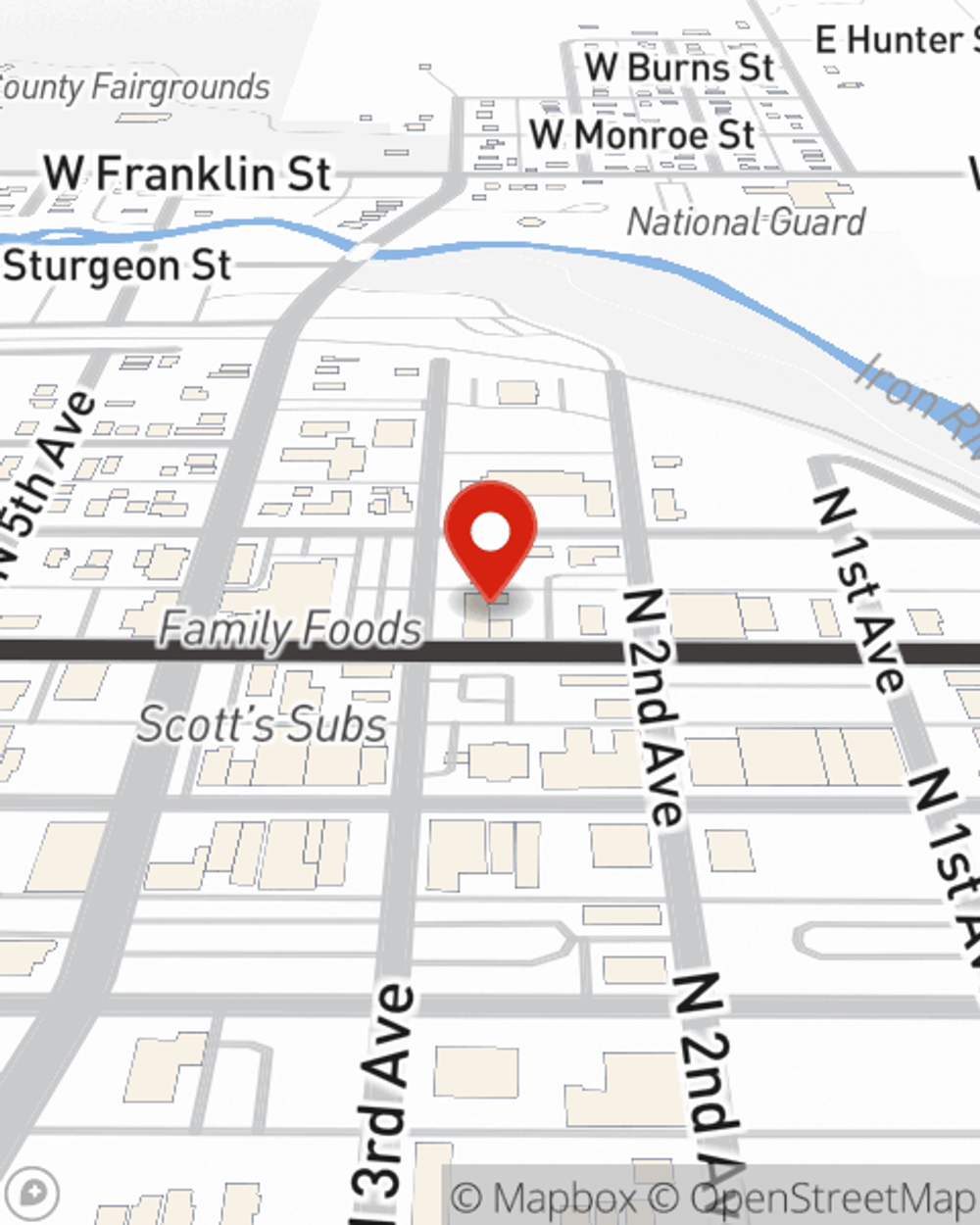

Business Insurance in and around Iron River

One of Iron River’s top choices for small business insurance.

Helping insure small businesses since 1935

- Crystal Falls

- Watersmeet

- Florence

- Caspian

- Long Lake

- Marenisco

- Wausaukee

- Laona

- Bruce Crossing

- Pickerel

- Trout Creek

- Rhinelander

- Alpha

- Marquette

- Norway

- Gaastra

- Amasa

- Iron Mountain

- Three Lakes

- Pembine

- Sagola

State Farm Understands Small Businesses.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected mishap or catastrophe. And you also want to care for any staff and customers who stumble and fall on your property.

One of Iron River’s top choices for small business insurance.

Helping insure small businesses since 1935

Customizable Coverage For Your Business

Protecting your business from these potential accidents is as easy as choosing State Farm. With this small business insurance, agent Marla Shamion can not only help you construct a policy that will fit your needs, but can also help you submit a claim should an issue like this arise.

Take the next step of preparation and visit State Farm agent Marla Shamion's team. They're happy to help you explore the options that may be right for you and your small business!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Marla Shamion

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.